As an ever increasingly popular category, Planned Unit Developments have enjoyed strong price growth while maintaining steady sales throughout the year. While most categories dropped significantly in the number of sales through the first two quarters, PUDs only had one less sale (26) in 2019 vs 27 total sales in 2018. This is likely due to the availability and accessibility …

Mid-Year Market Report: Condominiums

The limited number of condos for sale and a large number of buyers in Incline Village & Crystal Bay continues to push prices upward. The median sales price of $560,000 is one of the highest we have seen and exceeds the 2nd Quarter 2018 median sales price of $529,500 by 6%. In line with market trends, sales were down by …

Mid-Year 2019 Market Report: Single Family Homes

The housing market in Incline Village continued its growth with sales prices up 5% compared to last year at this time, resulting in a median sales price of $1,379,000 for a single-family home. The increasing prices of homes are largely due to the continuing trend of low inventory paired with a substantial winter. Home sales slowed by 13% with a total of …

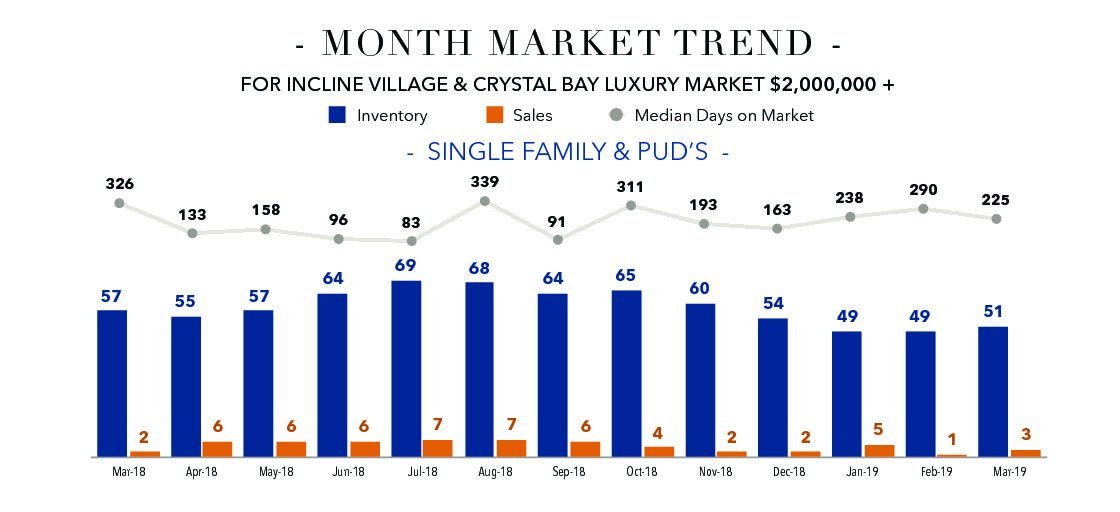

Is The Luxury Real Estate Market Starting To Slow Down Or Has It Merely Normalized?

Incline Village Luxury Market Trends Popular news and media outlets offer many differing theories as to what is influencing the spending of the wealthy and the state of the luxury market. Although the luxury market in Incline Village and Crystal Bay has much in common with other high-end markets, the factors influencing real estate sales in our area are unique. …

Incline Village Lakefront Estate Sells for $31.1 Million!

Incline Village Lakefront Sale: “Old Forge Estate“ Locals say there is something in the water and we tend to agree. Lake Tahoe is well known as one of the most beautiful and unique places in the world and our homes are no different. Lakeshore Realty is celebrating the sale of The Old Forge Estate, an Incline Village Lakefront and one …

Lake Tahoe Teardown? Here are four things to consider

Lake Tahoe Teardown: When communities age and inventory becomes tight, a new real estate trend tends to emerge: raze and rebuild. The Lake Tahoe teardown and rebuild trend is increasingly happening around the north shore of Lake Tahoe on the Nevada side, where Californians desire an escape from high taxes. When a strong economy typically results in a scarcity of nice …

Daily Market Update: Inman April 10th

30 year fixed rate mortgages averaged 4.1% last week which is down from 4.14% the week before. Last year at this time the rate was 3.59%. Although rates are rising, the increases seem to be mild and sustainable. The perception to borrowers though, could be a different matter. Those that are on the cusp of buying a home may be pushed …

Incline Village and Crystal Bay Real Estate Market Update: Q1 2017

Incline Village Market Update: The Incline Village market update for the first quarter of 2017 has seen a few surprises that most were not expecting. The biggest surprise came in the form of the lowest inventory of homes for sale in over 20 years! The winter months typically see a decrease in …

Incline Village Neighborhood Of The Week: Lakefront

Lakefront: This week our featured neighborhood in Incline Village is the Lakefront Subdivision! Incline Village and Crystal Bay real estate is broken down into 16 different “subdivisions” which are more commonly known as neighborhoods. You can see our subdivision map here to get an idea of where the Lakefront subdivision is located. This is possibly the most recognizable and sought after neighborhood …